Tax Season Risks

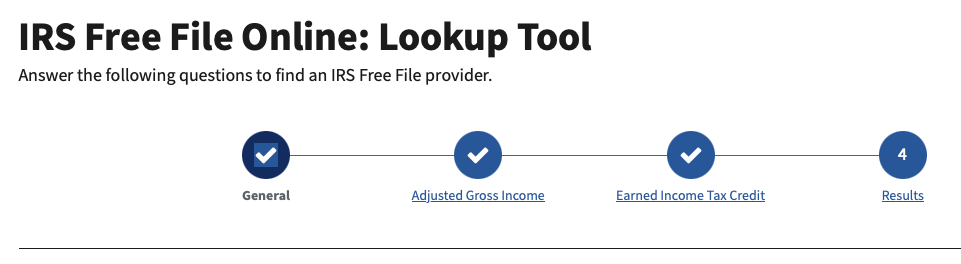

If you live in the US, you are likely aware that we are entering the last phase of the tax filing season. Returns are due April 15th, and scammers know that last-minute filing stress makes people less careful. Tax filings typically include sensitive PII like social security numbers, addresses, and other details. The IRS has, in recent years, tried to reduce fraud, but there are still several scams that are hard to eradicate. One of the significant risks is phishing, and one of the hooks that may be used is offers to file taxes for free. Legitimate providers of tax filing services do offer free services for simple returns. The IRS set up a specific site to find a provider for free filing services:

https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

Other legitimate websites may not be listed at the above IRS URL. But be very careful before submitting any personal information.

Phishing

Attackers routinely send phishing emails during tax season advertising fraudulent tax filing services.

Dark Patterns

Even if the IRS authorizes a company, they may still try hard to offer various for-pay options even if you qualify for the free offer. They often use "dark patterns, " making it difficult to find the right options to take advantage of the free offer.

Identity Theft

Fraudulent tax returns are one way for attackers to monetize personal data, particularly social security numbers. The attacker will file a tax return on your behalf, requesting a large refund. These refunds are often approved. Attackers file these returns as early as possible. The result will be that your refund will be rejected. This technique is often used to monetize social security numbers from minors to claim them as dependents on a fraudulent tax return. It can be difficult to recover if your tax return is rejected due to a fraudulent filing. You may need to file a police report for identity theft and include it with a mailed paper return. E-Filing will not be an option in this case.

Malware

One IRS-authorized site, efile[.]com (note: not e-file[.]com , may actually have been offering malware recently. I have not been able to verify this issue myself. A reader altered us of a report in any.run, showing a popup offering a malicious "Updater" for download [1]. Virustotal appears to have a sample of the downloaded "update.exe" [2]. At this time, only Crowdstrike and Cynet label it as malicious. I am not able to reproduce the possibly malicious popup. Attempts to trigger it from Safari (MacOS) and Microsoft Edge (Windows 10) failed. Please let me know if you see the popup.

Do not download any executable offered from any site (not just tax filing sites) unless you specifically ask for it, for example, to download the software you just purchased. Some tax filing sites may offer downloads of PDFs of your returns. Please let us know if you run into any issues like this.

In addition, it will be likely for attackers to offer tax preparation software that includes malware.

How to Defend Yourself

The best way to defend yourself: Do not wait until the last minute to file your taxes. In the past, filing websites often had difficulties keeping up with the last-minute rush of filings. Filing last minute will make it more likely that you click on the wrong link or fall for a scam, not having the time to carefully review what you click on. You may also qualify for an "Identity Protection PIN (IP PIN)" from the IRS. The IRS will mail you a PIN at the end of the year to use in your tax filing [2]. Stick with tax preparation options you know and trust. Do not just Google for tax preparation options.

[1] https://app.any.run/tasks/d25c5a78-d22f-4a8c-b714-73541a66a412/

[2] https://www.virustotal.com/gui/file/882d95bdbca75ab9d13486e477ab76b3978e14d6fca30c11ec368f7e5fa1d0cb/detection

[3] https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin

---

Johannes B. Ullrich, Ph.D. , Dean of Research, SANS.edu

Twitter|

| Application Security: Securing Web Apps, APIs, and Microservices | Las Vegas | Sep 22nd - Sep 27th 2025 |

Comments